Services

What We do

Portfolio Management Advisory

Curating Investment Masterpieces, One Asset at a Time

At the heart of wealth accumulation lies the intelligent assembly of a diversified investment portfolio. Halifax’s portfolio management advisory service is not a one-size-fits-all approach but a bespoke engagement where seasoned advisors dive deep into your financial profile, risk appetite, and life objectives.

Utilizing a disciplined investment philosophy, they blend equities, fixed-income instruments, real estate, and alternatives to construct portfolios that not only survive market volatility but thrive within it. Regular reviews, rebalancing, and performance tracking ensure your portfolio remains aligned with both your immediate needs and long-term aspirations.

Financial Planning

A Compass for the Entire Financial Journey

Sound financial planning is the cornerstone of a secure future. Halifax offers comprehensive financial planning services that span every stage of life from wealth creation to wealth preservation. Through careful consideration of income, expenditures, savings goals, and timelines, they help you structure a financial path as unique as your fingerprint.

This includes emergency fund strategies, major purchase planning, debt reduction frameworks, and contingency provisions. Halifax doesn’t just look at numbers; they understand the narrative behind your finances your dreams, responsibilities, and the legacy you want to build and design a plan to reflect just that.

Corporate Finance

Powering Sustainable Growth

As an SEC-licensed Investment Adviser in Ghana, Halifax provides comprehensive Corporate Finance services. We help businesses, from SMEs to large corporations, optimize their financial structures, raise capital, and execute strategic transactions. Our services are crucial for companies aiming to grow, restructure, or undergo significant ownership or operational changes.

Our Corporate Finance team acts as trusted advisors, leveraging expertise in financial markets, regulations, and strategic planning to guide clients through complex decisions.

Core Corporate Finance Offerings

Capital Raising (Equity & Debt): We advise on raising capital through equity (direct investments, GSE listings, public share issuance, connecting startups with investors) and debt (syndicated loans, debt instrument issuance, customized project finance).

Strategic Financial Advisory: We develop analyses for project viability, expansion, and market entry, advising on the financial structuring of large-scale projects. We also create sophisticated financial models and assist with government asset privatization.

Mergers & Acquisitions (M&A) Advisory: We assist with identifying, evaluating, and acquiring target businesses (including due diligence, valuation, negotiation, and deal structuring). We also guide owners through selling their company, division, or assets, and advise on strategic partnerships.

Corporate Restructuring and Valuation: We help companies facing financial distress or seeking to optimize capital structure (e.g., debt rescheduling, recapitalization, divestitures). We also provide independent valuations of businesses, assets, or projects for M&A, fundraising, financial reporting, or strategic planning, using methodologies like DCF, comparable company analysis, and precedent transactions.

How Halifax Delivers Corporate Finance Services

We combine an in-depth understanding of Ghana’s economic and regulatory landscape (SEC, Bank of Ghana, GSE) with industry-specific trends. We develop bespoke financial strategies tailored to each client’s unique needs. Our extensive network within the financial community facilitates successful transactions. We ensure strict adherence to all SEC Ghana regulations, maintain confidentiality, and provide unbiased advice to maximize client value.

By offering these comprehensive services, Halifax plays a vital role in enabling Ghanaian businesses to achieve their strategic and financial objectives, thereby contributing to the nation’s economic growth.

Retirement Planning

Because Life After Work Should Still Be Rich

Planning for retirement is not just about saving; it’s about envisioning the life you want when the paychecks stop but the living continues. Halifax’s retirement planning service works to ensure that you don’t outlive your savings, but instead live out your dreams.

From estimating future income needs to accounting for inflation, healthcare costs, and lifestyle goals, Halifax builds a structured plan around pensions, annuities, personal retirement accounts, and other vehicles. Whether you are decades away from retiring or at the doorstep of it, they ensure that your golden years remain golden.

Estate and Project Management Advisory

Planning Beyond a Lifetime and Executing Within It

Legacy is not just what you leave behind; it’s what you live for. Halifax’s estate planning ensures your assets are distributed according to your wishes, with minimal legal friction, family disputes, and tax exposure. From crafting wills and setting up trusts to managing philanthropic gifts, they help you shape a legacy of love, leadership, and lasting impact.

On the project management front, Halifax supports clients in overseeing large-scale financial endeavors — from property developments to business expansions. Their advisory ensures proper budgeting, resource allocation, stakeholder management, and timely delivery — because every grand vision needs a disciplined hand to become a reality.

Risk Management

Anticipating the Storms Before They Gather

Uncertainty is the only certainty in life and finance alike. Halifax offers robust risk management services that identify potential threats to your wealth and implement strategies to mitigate them. These include insurance planning, investment hedging, diversification techniques, and business continuity planning.

For entrepreneurs and investors, Halifax extends this service to operational and market risk ensuring your business or portfolio can absorb shocks and rebound stronger. Risk, when managed well, becomes not a threat but a tool for resilience.

Investment Consulting

Illuminating Investment Pathways with Expertise and Insight

The modern investment landscape is as vast as it is volatile. Halifax’s investment consulting services bring clarity to this complexity. Whether you’re a corporate entity managing an endowment, an individual evaluating real estate, or an institution considering venture capital, their consultants provide rigorous due diligence, market insights, and feasibility assessments.

They do more than analyze the numbers — they interrogate the strategy, align it with your goals, and suggest structures that maximize returns while respecting your tolerance for risk.

Alternative Investments

Exploring Opportunities Off the Beaten Path

For investors looking to diversify beyond the traditional, Halifax opens doors to alternative investments, private equity, hedge funds, commodities, infrastructure projects, and more. These asset classes offer the potential for higher returns, lower correlation to public markets, and a broader base for wealth building.

Understanding that alternatives also come with unique risks, Halifax performs deep due diligence and maintains transparent reporting, so clients are well-informed and empowered in every step of their investment journey.

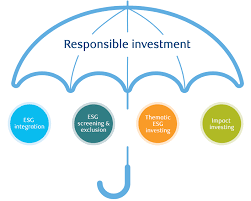

ESG & Impact Investing

Investing with Heart, Mind, and a Conscience

Today’s investors are no longer satisfied with returns alone; they want their money to make a difference. Halifax supports clients who seek to align their portfolios with Environmental, Social, and Governance (ESG) principles or invest in ventures that generate measurable social and environmental impact.

From green bonds to social enterprises, they identify opportunities that allow you to grow wealth while championing sustainability, ethics, and justice. For Halifax, impact investing isn’t a trend it’s a commitment to the future we all share.